Running a successful e-commerce business requires a seamless and secure payment process. Choosing the right e-commerce payment gateway is crucial for accepting online payments and ensuring customer trust. This comprehensive guide will delve into the intricacies of e-commerce payment gateways, providing you with the knowledge to choose the best solution for your business needs. We’ll cover everything from the basics of how online payment processing works to the various types of gateways available, including payment gateway providers and the important features to consider. Whether you’re just starting your online store or looking to optimize your existing payment processing system, understanding e-commerce payment gateways is essential for success in the competitive online marketplace.

This guide will act as your complete resource, providing valuable insights into payment gateway integration, security considerations, and the latest trends in online payments. We’ll explore the different pricing models and fees associated with e-commerce payment gateways, helping you make informed decisions about cost management. By understanding the various factors involved, from payment gateway security to mobile payments, you can optimize your e-commerce payment processing and create a positive customer experience. This guide will empower you to navigate the world of e-commerce payment gateways with confidence and choose the optimal solution for your specific online payment needs.

What is an E-Commerce Payment Gateway?

An e-commerce payment gateway is a technology that acts as a bridge between your online store and the payment processor. It securely authorizes payments for online and e-commerce transactions. Think of it as the digital equivalent of a physical point-of-sale (POS) terminal you see in brick-and-mortar stores.

When a customer makes a purchase on your website, the payment gateway securely captures their payment information, such as credit card details, and transmits it to the payment processor for authorization.

The gateway then relays the approval or decline back to your website, allowing the transaction to be completed or cancelled. This entire process happens seamlessly and securely within seconds, ensuring a smooth checkout experience for your customers and protecting sensitive financial data.

Essentially, a payment gateway enables businesses to accept a wide range of online payment methods, expanding their customer base and facilitating global transactions.

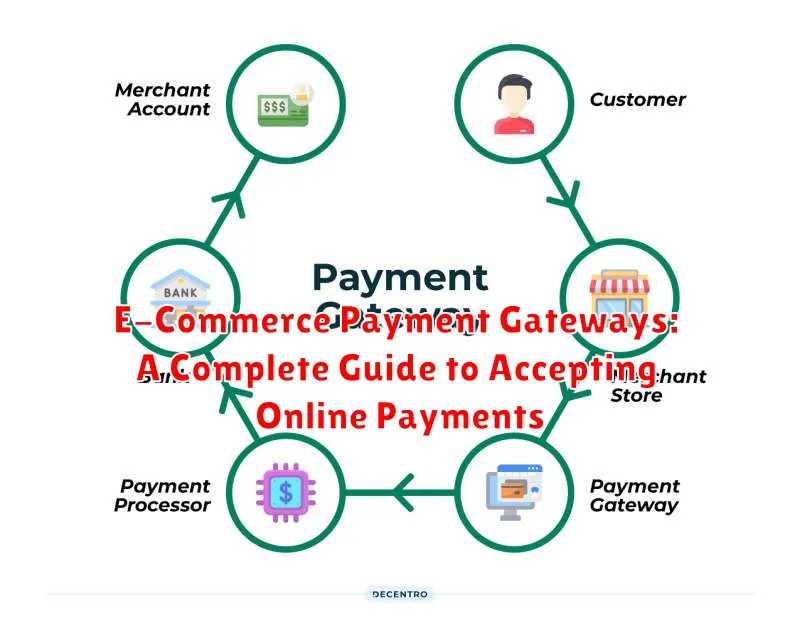

How Does a Payment Gateway Work?

A payment gateway acts as a secure bridge between your online store and the payment processor, facilitating the transfer of transaction information for authorization and settlement.

The process begins when a customer initiates a purchase on your website. They enter their payment details, which are then encrypted and securely transmitted to the payment gateway.

The payment gateway forwards this information to the payment processor, who then communicates with the customer’s issuing bank to verify the funds and authorize the transaction. The result (approval or decline) is relayed back to the payment gateway, then to your website, and finally to the customer.

Upon successful authorization, the payment gateway facilitates the settlement of the transaction, transferring the funds from the customer’s account to your merchant account.

Think of it as a highly secure messenger service that ensures the safe and efficient transfer of sensitive payment information, safeguarding both the customer and the merchant.

Types of Payment Gateways Available

Several types of payment gateways cater to different business needs and technical setups. Understanding these distinctions helps in selecting the most suitable option.

Hosted Payment Gateways

With hosted gateways, the customer is redirected to the payment provider’s platform to complete the transaction. This simplifies PCI DSS compliance for merchants as sensitive data is not handled directly on their servers.

Self-Hosted Payment Gateways

These gateways allow merchants to keep customers on their website throughout the checkout process, offering a more seamless user experience. However, this option requires more stringent security measures and PCI DSS compliance efforts.

API Hosted Payment Gateways

API-hosted gateways offer a balance between control and security. Merchants can integrate the gateway directly into their website or app using APIs, providing a customized checkout experience while leveraging the gateway’s security infrastructure.

Local Bank Integrators

These gateways facilitate direct integration with local banks, streamlining transactions and potentially offering lower processing fees. However, they may limit international transactions and offer fewer features compared to other types.

Key Features to Look for in a Payment Gateway

Selecting the right payment gateway involves considering several key features to ensure smooth and secure transactions for your business. Here’s a breakdown of essential aspects:

Security

Security is paramount. Look for gateways with robust fraud prevention tools, including address verification (AVS), card verification value (CVV) checks, and 3D Secure authentication (like Verified by Visa or Mastercard SecureCode). Data encryption and PCI DSS compliance are non-negotiable.

Supported Payment Methods

The gateway should support a wide range of payment methods relevant to your target audience. This may include major credit and debit cards (Visa, Mastercard, American Express, Discover), digital wallets (Apple Pay, Google Pay), and other options like ACH transfers or buy now, pay later services.

Transaction Fees and Pricing

Understand the fee structure. Gateways typically charge per-transaction fees, monthly fees, or a combination of both. Evaluate different pricing models to determine the most cost-effective solution for your sales volume.

Integration and Compatibility

Seamless integration with your existing e-commerce platform and other business tools is crucial. Ensure compatibility with your shopping cart software and other systems like CRM and accounting software.

Customer Support

Reliable customer support is essential for troubleshooting technical issues and addressing any payment processing challenges that may arise.

Choosing the Right Payment Gateway for Your Business

Selecting the right payment gateway is crucial for a successful e-commerce business. Several factors influence this decision and should be carefully considered.

Business Size and Sales Volume: Startups may find a basic, low-cost gateway sufficient, while larger enterprises with higher transaction volumes may require a more robust solution with advanced features.

Target Audience: Consider where your customers are located. If you operate internationally, you’ll need a gateway that supports multiple currencies and payment methods popular in those regions.

Security: PCI DSS compliance is non-negotiable. Ensure the gateway adheres to the highest security standards to protect sensitive customer data.

Integration with Existing Platforms: Seamless integration with your e-commerce platform and other business tools streamlines operations. Check compatibility with your current setup.

Pricing and Fees: Carefully analyze transaction fees, monthly fees, and any setup costs. Choose a pricing structure that aligns with your budget and sales projections.

Customer Support: Reliable customer support is essential, especially if technical issues arise. Look for gateways offering prompt and efficient support channels.

Integrating a Payment Gateway with Your Online Store

Integrating a payment gateway is crucial for accepting online payments. The process typically involves selecting a provider and then integrating their solution with your e-commerce platform.

Choosing the right gateway depends on several factors, including your business size, transaction volume, and required features. Consider transaction fees, supported currencies, and security measures when making your decision.

Integration methods vary depending on the platform and gateway. Some gateways offer pre-built plugins or extensions for popular platforms, simplifying the process. Others provide APIs that require custom development to integrate with your specific system.

Regardless of the method, the integration process generally involves exchanging data between your online store and the payment gateway. This includes transmitting order details, customer information, and payment information securely. Testing the integration thoroughly before going live is essential to ensure a seamless checkout experience for your customers.

Security Considerations for Online Payments

Security is paramount when accepting online payments. PCI DSS compliance is crucial. This standard mandates security measures for handling cardholder data, protecting businesses and customers alike.

SSL encryption is essential for securing data transmitted between the customer’s browser and your server. This prevents eavesdropping and data theft.

Implementing strong authentication methods, such as two-factor authentication, adds another layer of security, preventing unauthorized access to payment information.

Regularly monitoring transactions for suspicious activity can help detect and prevent fraud. This might involve setting thresholds for transaction amounts or flagging unusual patterns.

Choosing a reputable payment gateway provider is critical. Ensure they adhere to industry best practices and offer robust security features.

Troubleshooting Common Payment Gateway Issues

Encountering payment gateway issues can be frustrating for both merchants and customers. Here’s a guide to troubleshooting some common problems:

Declined Transactions: This is often due to insufficient funds, incorrect card details, or expired cards. Advise customers to double-check their information. Address verification system (AVS) mismatches can also cause declines. Ensure customers enter their billing address precisely as it appears on their card statement.

Connection Errors: Issues with internet connectivity, either on the customer’s or merchant’s end, can interrupt transactions. Check your internet connection and advise the customer to do the same. Temporary outages with the payment gateway itself are also possible. Consider displaying status updates from your provider if available.

Authorization Failures: These can stem from issues with the customer’s bank or exceeding credit limits. Advise customers to contact their bank. Incorrect configuration of the payment gateway on the merchant’s side can also lead to authorization failures. Verify your settings with your payment gateway provider.

Recurring Billing Issues: Problems with recurring billing often involve expired cards or changes in customer billing information. Implement systems to remind customers to update their card details and ensure your system handles updates gracefully.

Tips for Optimizing Your Payment Process

Optimizing your payment process is crucial for minimizing cart abandonment and enhancing customer satisfaction. A streamlined checkout experience encourages conversions and fosters customer loyalty.

Offer a variety of payment methods to cater to a wider customer base. Supporting popular options like credit cards, debit cards, and digital wallets such as Apple Pay or Google Pay, can significantly improve the customer experience.

Minimize required fields during checkout. Only request essential information to reduce friction and speed up the process. A lengthy form can deter customers from completing their purchase.

Clearly display security badges to build trust and reassure customers that their payment information is safe. This can alleviate concerns about online security and encourage completion of transactions. Displaying logos from reputable security providers can be highly effective.

Regularly test your payment gateway to ensure it’s functioning correctly. Testing various scenarios, including successful and failed transactions, helps identify and resolve potential issues before they affect customers.