In today’s digital marketplace, a robust and reliable payment processor is essential for the success of any online business. Understanding the complexities of payment processing can be daunting, with various options, fees, and security considerations to navigate. This comprehensive guide aims to demystify the world of online payment processing, providing you with the knowledge necessary to choose the best solution for your business needs. We will explore the different types of payment gateways, discuss transaction fees, and highlight the importance of payment security.

From merchant accounts to payment integration, this guide will decode the key aspects of payment processors, offering practical insights and actionable advice. Whether you are a startup or an established enterprise, understanding the intricacies of online payment systems is crucial for optimizing your revenue streams and ensuring a seamless customer experience. This article will equip you with the knowledge to make informed decisions regarding payment processing solutions, empowering you to navigate the digital landscape with confidence and maximize your online business potential.

What is a Payment Processor?

A payment processor is a company that acts as the intermediary between your business, your customer, and the financial institutions involved in an online transaction. They facilitate the secure transfer of funds from the customer’s bank account (or credit card) to your business’s bank account. Essentially, they handle the complex behind-the-scenes processes of authorizing and settling payments.

Think of a payment processor like a bridge. On one side is your customer making a purchase, and on the other side is your business receiving payment. The payment processor is the structure that connects them, ensuring the money travels safely and efficiently. They manage the communication between various parties, including:

- The customer’s bank (issuing bank)

- The merchant’s bank (acquiring bank)

- The card networks (e.g., Visa, Mastercard, Discover)

Payment processors are crucial for any online business, allowing you to accept various payment methods, from credit and debit cards to digital wallets and more, without having to directly manage the intricate financial details.

How Payment Processors Work

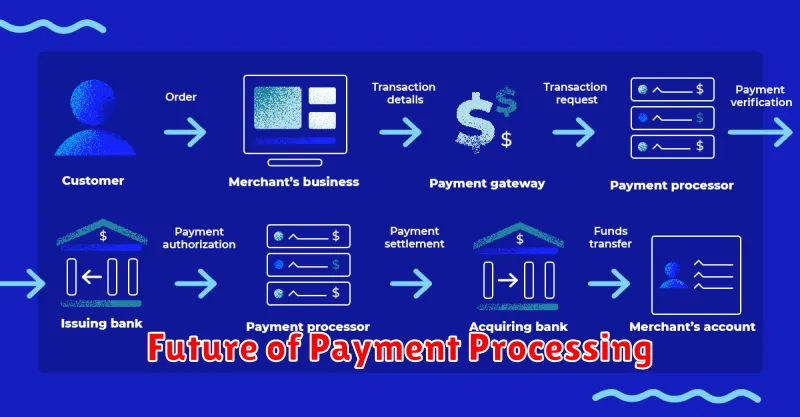

Payment processors act as the crucial intermediary between your online business, the customer, and the various financial institutions involved in a transaction. They facilitate the complex movement of funds securely and efficiently.

The process begins when a customer initiates a purchase on your website. The payment information, such as credit card details, is securely transmitted to the payment processor.

The payment processor then communicates with the customer’s issuing bank to verify the funds’ availability and authorize the transaction. Simultaneously, it interacts with your merchant account, which is a special bank account designed to receive payments.

Upon successful authorization, the funds are transferred from the customer’s account to your merchant account. The payment processor then notifies both parties of the successful transaction.

Security plays a vital role in this process. Payment processors employ encryption and other security measures to protect sensitive financial data from fraud and unauthorized access.

Types of Payment Processors

Payment processors generally fall into a few key categories, each designed to handle transactions in a slightly different way. Understanding these types is crucial for selecting the best fit for your business.

Merchant Account Providers

These processors offer a dedicated merchant account, acting as an intermediary between your business, the card networks, and the issuing banks. They typically handle the entire transaction process, from authorization to settlement.

Payment Gateway Providers

Payment gateways act as a secure portal, transmitting transaction data between your website or point-of-sale system and the payment processor. They encrypt sensitive data, ensuring secure transactions. While some gateways offer all-in-one solutions, others primarily focus on the gateway functionality and require a separate merchant account.

Payment Aggregators

Aggregators allow businesses to accept payments without needing a dedicated merchant account. They group multiple merchants under their own umbrella account, streamlining the onboarding process, particularly beneficial for smaller businesses or startups.

Key Features of a Payment Processor

When selecting a payment processor, several key features contribute to a seamless and secure transaction experience for both businesses and customers. Understanding these features helps businesses make informed decisions.

Security is paramount. Look for features like fraud detection, PCI DSS compliance, and data encryption to protect sensitive customer information.

Accepted Payment Methods are crucial for reaching a wider audience. A good processor supports various options, including major credit and debit cards, digital wallets, and potentially even alternative payment methods.

Processing Fees and other costs should be transparent. Consider transaction fees, monthly fees, and any chargeback fees.

Integration with existing platforms is important for streamlined operations. Check for compatibility with your e-commerce platform, accounting software, and other business tools.

Customer Support is essential for troubleshooting and resolving issues. Look for processors that offer reliable and accessible support channels.

Choosing the Right Payment Processor for Your Business

Selecting the right payment processor is crucial for the success of your online business. Several factors should influence your decision. Transaction fees are a primary concern. Carefully compare the per-transaction costs, monthly fees, and any other charges.

Supported payment methods are another key consideration. Does your target audience prefer credit cards, debit cards, digital wallets, or alternative payment methods? Ensure the processor supports the options your customers expect.

Security is paramount. Look for processors that offer robust fraud protection and data security measures like PCI DSS compliance. Integration with your existing e-commerce platform and other business tools simplifies operations. Check for seamless compatibility.

Finally, consider the scalability of the payment processor. As your business grows, your processing needs will evolve. Choose a processor that can accommodate increasing transaction volumes and expanding business requirements.

Benefits of Using a Payment Processor

Integrating a payment processor offers numerous advantages for online businesses, streamlining transactions and boosting overall performance. Increased Efficiency is a key benefit, automating payments and reducing manual processing. This frees up valuable time and resources for other business operations.

Improved Customer Experience is another significant advantage. Payment processors offer a seamless and convenient checkout process, supporting various payment methods like credit cards, debit cards, and digital wallets. This flexibility caters to a wider customer base and enhances their shopping experience.

Enhanced Security is paramount. Reputable payment processors adhere to strict security standards, including PCI DSS compliance, safeguarding sensitive customer data and reducing the risk of fraud. This builds trust and credibility with customers.

Finally, using a payment processor often leads to Increased Sales. The streamlined checkout process and multiple payment options can reduce cart abandonment rates and encourage higher conversion rates. This directly translates to improved revenue generation.

Security Considerations for Payment Processing

Security is paramount when processing payments online. PCI DSS compliance is a crucial standard for any business handling cardholder data. This framework sets requirements for security management, policies, procedures, network architecture, software design, and other critical protective measures.

Data encryption is another essential element. Encrypting sensitive data both in transit and at rest protects against unauthorized access. Look for payment processors that utilize robust encryption protocols like TLS and AES.

Fraud prevention tools are also vital. Features like address verification, CVV checks, and 3D Secure authentication can help minimize fraudulent transactions. Real-time fraud monitoring and scoring can further enhance security.

Tokenization replaces sensitive card data with unique tokens, further reducing the risk of data breaches. By storing tokens instead of actual card numbers, businesses minimize their exposure to sensitive information.

Integrating a Payment Processor into Your Online Store

Integrating a payment processor is crucial for accepting online payments. The process generally involves choosing a processor, signing up for an account, and then technically integrating it with your online store.

Most processors offer detailed documentation and support to guide you through integration. There are typically two primary integration methods: direct integration and redirecting to a payment gateway.

Direct integration, often using APIs, allows customers to complete their purchase without leaving your website. This provides a smoother, more seamless checkout experience.

Redirecting to a payment gateway involves sending customers to the processor’s secure server to complete the transaction. After payment, they are redirected back to your site. While slightly less seamless, this option is often simpler to implement initially.

Selecting the right integration method depends on your technical capabilities and the specific requirements of your business. Factors such as transaction volume and desired level of customization will influence your decision. Carefully review your options and choose the method best suited for your online store.

Future of Payment Processing

The future of payment processing is marked by continuous innovation, driven by evolving consumer behavior and technological advancements. Invisible payments are becoming increasingly prevalent, embedding the payment process seamlessly within the customer journey. Think purchasing groceries online and having them delivered without a separate checkout step.

Biometric authentication offers enhanced security and convenience. Fingerprint scanning and facial recognition are already common, and more sophisticated methods are on the horizon. This reduces reliance on passwords and PINs, streamlining the payment experience.

Cryptocurrency and blockchain technology are also poised to disrupt traditional payment systems. While still facing regulatory hurdles and scalability challenges, they hold the potential for faster, cheaper, and more secure transactions. The widespread adoption of digital currencies could reshape the financial landscape.

The rise of artificial intelligence (AI) and machine learning will contribute to more personalized and fraud-resistant payment systems. AI can analyze transaction data in real-time to detect and prevent fraudulent activities, improving security for both businesses and consumers.