In today’s digital marketplace, a robust and secure payment gateway is crucial for any successful e-commerce business. E-commerce payment gateways act as the bridge between your customers and your business, facilitating secure online transactions and ensuring smooth payment processing. Choosing the right gateway can significantly impact your conversion rates, customer experience, and ultimately, your bottom line. This comprehensive guide will navigate you through the complexities of e-commerce payment gateways, providing you with the knowledge to make an informed decision for your business. We’ll delve into the various types of gateways, key features, security considerations, and the latest trends shaping the future of online payments.

From credit card processing and alternative payment methods to fraud prevention and PCI compliance, this guide will cover everything you need to know about selecting, integrating, and managing an e-commerce payment gateway. Whether you’re launching a new online store or looking to optimize your existing payment infrastructure, understanding the nuances of payment gateways is essential. This guide will empower you to choose the best payment gateway for your specific business needs, ensuring secure and seamless transactions for your customers while maximizing your business’s potential.

Understanding E-Commerce Payment Gateways

In the realm of online business, e-commerce payment gateways play a critical role. They are the bridge that connects your online store to the payment processing networks, allowing you to securely accept payments from customers.

Think of a payment gateway as the digital equivalent of a physical point-of-sale terminal in a brick-and-mortar store. It authorizes the transfer of funds between the customer’s bank account and your merchant account.

This process facilitates a seamless transaction experience, enabling customers to pay for goods and services using various methods like credit cards, debit cards, and sometimes even alternative payment options like digital wallets.

By using a payment gateway, businesses can securely process transactions, manage payment data, and ensure the integrity of financial information. A reliable payment gateway is essential for building trust with customers and maintaining a successful online business.

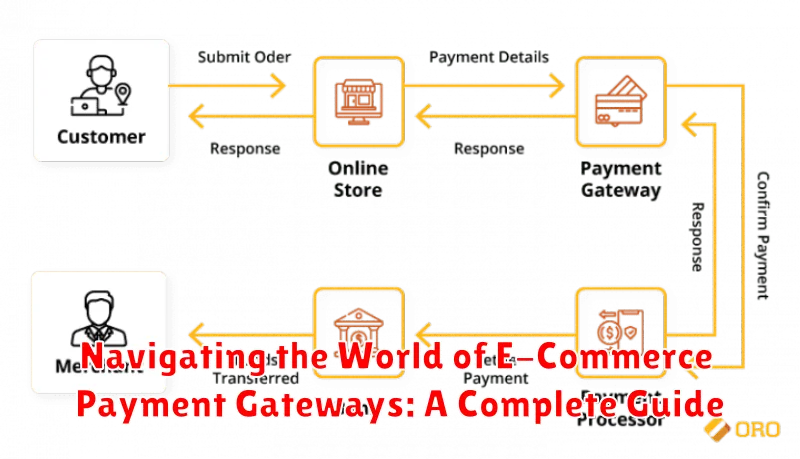

How Payment Gateways Work

A payment gateway acts as a bridge, securely connecting your online store to the payment processor. It facilitates the transfer of transaction information between the customer, the merchant, and the financial institutions involved.

The process begins when a customer initiates a purchase. The payment gateway securely captures the customer’s payment information, encrypts it, and transmits it to the payment processor for authorization.

The payment processor then communicates with the relevant card networks (e.g., Visa, Mastercard) to verify the customer’s funds and approve or decline the transaction.

This authorization response is relayed back to the merchant through the payment gateway, allowing the transaction to be completed or flagged as unsuccessful. This entire process happens within seconds, providing a seamless checkout experience for the customer.

Security is paramount in this process. Payment gateways use encryption and other security protocols to protect sensitive data and minimize the risk of fraud.

Types of Payment Gateways Available

E-commerce businesses can choose from a variety of payment gateway solutions, each with its own set of features and functionalities. Understanding these different types is crucial for selecting the right gateway for your specific needs.

Hosted Payment Gateways

With hosted payment gateways, customers are redirected to a third-party payment page to complete their transaction. This option simplifies PCI DSS compliance for merchants, as sensitive payment data is handled off-site.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to enter their payment information directly on your website. While offering a more seamless checkout experience, this option requires greater attention to security and PCI DSS compliance.

API Hosted Payment Gateways

API hosted gateways offer a balance between the previous two. Merchants integrate the gateway’s API into their website, allowing for a customized checkout experience while still leveraging the gateway’s security infrastructure.

Local Bank Integrators

These gateways connect directly with local banks, streamlining transactions within a specific region. They are often a good choice for businesses operating primarily in a single country.

Key Features to Consider When Choosing a Payment Gateway

Selecting the right payment gateway is crucial for a successful e-commerce business. Several key features should be carefully evaluated.

Transaction Fees: Compare different pricing models, including per-transaction fees, monthly fees, and any setup costs. Consider your average transaction value and sales volume to determine the most cost-effective option.

Supported Payment Methods: Ensure the gateway supports the payment methods your target audience prefers. This may include major credit and debit cards, digital wallets, and other regional payment options.

Security Features: Prioritize gateways with robust security measures, such as PCI DSS compliance, fraud prevention tools, and data encryption. This protects both your business and your customers’ sensitive information.

Integration and Compatibility: Confirm seamless integration with your existing e-commerce platform and other business tools. A smooth integration simplifies transaction processing and data management.

Customer Support: Reliable customer support is essential for troubleshooting any issues that may arise. Look for gateways offering responsive support channels, such as phone, email, or live chat.

Security Measures and Compliance Requirements for Payment Gateways

Security is paramount when processing online payments. Payment gateways must employ robust measures to protect sensitive data. PCI DSS (Payment Card Industry Data Security Standard) compliance is essential. This standard mandates specific security protocols for handling cardholder data, including encryption, secure storage, and regular vulnerability assessments.

Gateways should utilize encryption technologies like TLS (Transport Layer Security) to secure data transmitted between the customer, merchant, and payment processor. Tokenization replaces sensitive card details with unique tokens, further minimizing the risk of data breaches.

Fraud prevention tools are crucial. These include address verification (AVS), card verification value (CVV) checks, and 3D Secure authentication (like Verified by Visa or Mastercard SecureCode). These tools help identify and prevent fraudulent transactions.

Compliance requirements extend beyond PCI DSS. Depending on the region and industry, gateways must adhere to regulations like GDPR (General Data Protection Regulation) and other data privacy laws. Staying up-to-date with evolving regulations is vital for maintaining a secure and compliant payment environment.

Integrating Payment Gateways with Your E-Commerce Platform

Integrating a payment gateway is a critical step in setting up your e-commerce business. This process connects your online store to the payment processing network, enabling you to securely accept payments from customers.

Choosing the right gateway depends on several factors, including your business size, transaction volume, and budget. Popular options include hosted gateways, where transactions are processed on the provider’s server, and self-hosted gateways, offering more control but requiring more technical expertise.

Integration typically involves installing a plugin or extension provided by your chosen gateway, or using an API for more custom integrations. You’ll need to configure settings like merchant ID, security keys, and transaction currencies.

Testing the integration is crucial before going live. This ensures that transactions are processed smoothly and securely. Use test cards and transactions to verify different scenarios before accepting real payments from customers.

Optimizing Payment Gateways for Conversions and Customer Experience

Optimizing your payment gateway is crucial for maximizing conversions and creating a seamless customer experience. A frictionless checkout process encourages customers to complete their purchases, reducing cart abandonment rates.

Minimize steps required to complete a transaction. A lengthy or complicated checkout process can deter customers. Offer guest checkout options and streamline data entry fields.

Offer multiple payment options. Supporting a variety of payment methods, including credit cards, debit cards, digital wallets, and even buy now, pay later options, caters to a wider customer base and increases conversion opportunities. Consider regional preferences when selecting payment methods.

Mobile optimization is essential. Ensure your payment gateway is fully responsive and functions flawlessly on all mobile devices. A smooth mobile experience is paramount for capturing sales from on-the-go shoppers.

Security is paramount. Displaying security badges and clearly communicating your commitment to data protection builds trust and encourages customers to confidently share their payment information.

Troubleshooting Common Payment Gateway Issues

Encountering payment gateway issues can be frustrating for both businesses and customers. Swiftly identifying and resolving these problems is crucial for maintaining a smooth checkout process and minimizing lost sales.

Common issues include declined transactions, connection errors, and authorization failures. Declined transactions often stem from insufficient funds, incorrect card details, or security flags raised by the issuing bank. Connection errors can be caused by server downtime, network problems, or incorrect gateway configuration. Authorization failures may arise from issues with the customer’s bank or mismatches between the entered information and the card details on file.

Troubleshooting steps typically involve verifying the entered information, checking the gateway connection, and contacting customer support for assistance. Reviewing transaction logs and error messages can provide valuable insights into the root cause of the problem.

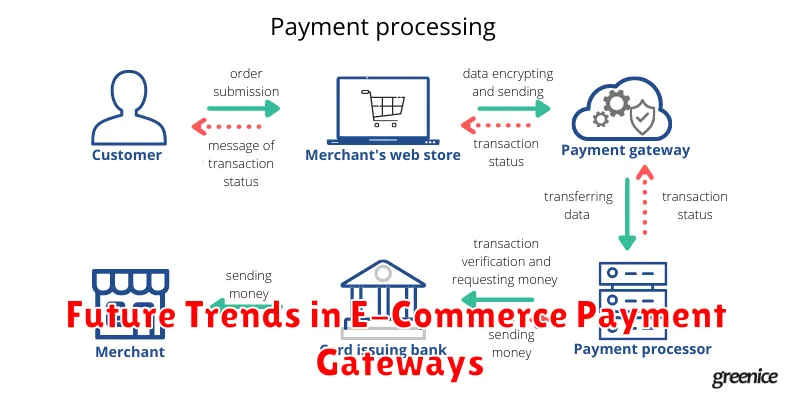

Future Trends in E-Commerce Payment Gateways

The landscape of e-commerce payment gateways is constantly evolving. Several key trends are shaping the future of online transactions, promising both enhanced security and a more seamless customer experience.

Invisible payments are gaining traction. These aim to make the payment process as frictionless as possible, embedding it directly within the user journey. Think one-click purchases and automated subscription renewals.

Biometric authentication is another area of growth. Fingerprint scanning and facial recognition offer robust security and simplify the checkout process, reducing reliance on passwords and PINs.

The rise of mobile wallets and other alternative payment methods continues. These offer customers increased flexibility and choice, allowing them to pay using their preferred method.

Finally, artificial intelligence (AI) is playing an increasingly important role in fraud detection and prevention. AI-powered systems can analyze vast amounts of data in real-time to identify and flag suspicious transactions, protecting both merchants and consumers.